Mining in 2026: Turning complexity into competitive advantage

Published by Jody Dodgson,

Editorial Assistant

Global Mining Review,

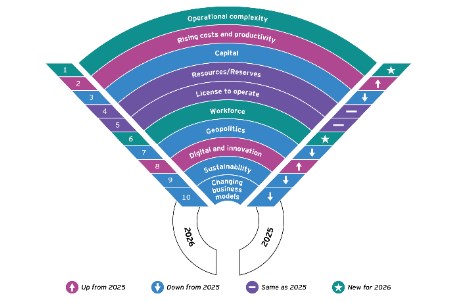

Despite the positive outlook for mining and metals, EY’s survey of senior mining and metals executives from around the world indicated a pivot away from external and strategic issues to short-term operational factors impacting productivity and costs. This is caused by global uncertainty and a desire to strengthen balance sheets and underlying profits before committing to major projects. Operational complexity tops the risk list this year in its first appearance, underscoring the pressure to deliver profitable and predictable output as mines get deeper, ore grades decline, and costs increase.

Operational complexity: the new no. 1 risk

Operational complexity is now ranked the top risk and opportunity for miners. The average grade of copper mined worldwide has declined by about 40% since 1991, and iron ore benchmarks are shifting to lower grades. As high-grade orebodies are depleted, miners are forced into going deeper and into more remote, geologically complex regions, driving up costs and straining logistics and workforce availability.

Regulatory delays, labour shortages, and infrastructure bottlenecks are also significant production constraints. For example, processing plant capacity can be overestimated, with actual throughput impacted by feed variability and declining grades. Maintenance discipline is slipping, with evidence suggesting that optimal preventative replacement could yield an average cost saving of 15%.

Rising costs and productivity pressures

Cost pressures have intensified, with the average corporate income tax and royalty rate for ICMM members climbing to 40.6% in 2024, up 7.7% from the previous year. Energy and labour costs remain elevated above pre-pandemic levels in most markets except nickel, where lower prices led to reduced production by high-cost miners. Margins are further squeezed by new trade tariffs and persistent inflation.

Capital allocation shifts to growth and future-facing minerals

Miners are decisively shifting capital allocation toward growth and future-facing minerals. For three consecutive years, companies have increased capital expenditure while reducing shareholder returns, reflecting a growth mindset supported by shareholders. Brownfield projects are favoured over greenfield exploration, raising concerns about long-term reserve sustainability and supply.

Strategic mergers highlight the industry’s drive to secure essential minerals and metals. However, large deals remain complex, requiring shareholder and regulatory buy-in at a time when governments are tightening control over strategic minerals.

Geopolitics, workforce, and digital innovation

Geopolitical risk, while lower in the rankings, remains a persistent threat. Trade barriers, resource nationalism, and supply chain disruptions are reshaping global flows. The sector faces a worsening skills crisis: over half of the US and Canadian mining workforce is expected to retire in the next decade, and a 10% increase in the Australian mining workforce is needed to meet demand from over 100 new projects in the next five years.

Digital transformation is now essential. 69% of miners report their greatest skills need is in digital capabilities, and 21% say they will invest more than 20% of their additional budget in AI over the next 12 months.

The future belongs to those miners who can combine strategic vision with operational excellence – embracing innovation, collaboration, and agility. With ore grades falling, costs rising, and the global demand for strategic minerals accelerating, mining companies must turn complexity into competitive advantage.

Paul Mitchell, Global Mining & Metals Leader, EY

Read the article online at: https://www.globalminingreview.com/finance-business/05112025/mining-in-2026-turning-complexity-into-competitive-advantage/

You might also like

Momentum builds at Lindian’s Kangankunde Rare Earths Project

Lindian Resources has published an update on on-site construction activities at the Kangankunde Rare Earths Project in Malawi, including the commencement of the mobilisation of the Komatsu owner-operator mining fleet.